CRISL Wins the Asset’s Triple A Regional Award for being the best rating agency of Bangladesh

CRISL Wins the Asset’s Triple A Regional Award for being the best rating agency of Bangladesh

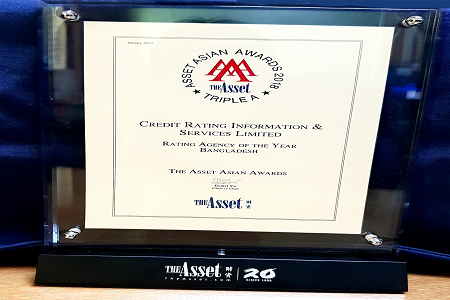

Credit Rating Information and Services Limited (CRISL), the oldest and the first ever multinational rating agency of the country, has been adjudged the best rating agency of Bangladesh and awarded the prestigious ‘The Asset’s Triple A Regional Award, 2018’ by the Hong Kong based leading financial publication and research organization, ‘The Asset’ recently.

On behalf of CRISL, Ms. Sarwat Amina, Executive Vice President, received the Award in a grand gala ceremony organized by the Asset at a hotel in Hong Kong recently.

The Asset’s Triple A recognition represents the industry’s most prestigious awards for banking, finance, treasury, trade, capital market and rating agencies, who have excelled in their respective industries over a considerable period of time.

Asset’s award programs are built upon a stringent methodology for selecting the best institutions and individuals operating in Asia. The honors are adjudicated by the Asset’s Board of Editors and an experienced research team with decades of experience in evaluating profiles of the companies operating in different sectors in Asia. Other than CRISL, Malaysian Rating Corporation, the leading rating agency in Malaysia, also won the award for 2018.

The Asset awards are Asia’s prominent recognition for those that have excelled in their respective industries with close to 20 years of experience in conducting award programs distinguishing the best organizations. The Award criterion are: Transparency in the rating methodology, default ratio, rating transition, methodology applied for investor protection, investor outreach education etc.

Established in 1995, CRISL is the pioneer in establishing credit rating practices in Bangladesh and has so far rated more than 27000 entities and exposures covering the entire financial sector which include banks, non-bank financial institutions, insurance companies, corporates, bonds, real estates, SMEs from its offices at Dhaka, Chottogram, Khulna, Rajshahi and Sylhet. CRISL’s Cumulative Default Rate (CDR) and Transition Matrix (TM) are in line with CDR/TM of other regional rating agencies.